Written by Michael LaPick

Healthcare Writer

We want to help you make educated healthcare decisions. While this post may have links to lead generation forms, this won’t influence our writing. We adhere to strict editorial standards to provide the most accurate and unbiased information.

Key Findings

- 61% of Texans are very or somewhat concerned that a major health situation in their household could lead to bankruptcy or debt.

- 58% of Texans say they are uninsured because they can’t afford it.

- 52% of Texans opted out of healthcare services in the past year.

Most Texans worry a major illness could leave them in a financial hole. A majority stayed away from the doctor this past year. And of those who lack health insurance, more than half said it was because they couldn’t afford it.

The findings come from a new survey on Texans’ health finances by HealthCareInsider.com.

61% of Texans aged 18 and over, for example, said they’re very or somewhat concerned a major health situation in their household could lead to bankruptcy or debt.

Affordability Preventing Texans from Getting Insured

Texas’ uninsured rate is 21%. Asked why they’re uninsured, 58% of Texans without coverage said it was because they couldn’t afford it.

The second and third highest reasons these Texans cited for being uninsured were job-related loss of employer health coverage (14%), and being self-employed (13%).

Over Half of Texans Foregoing Healthcare

Over half, or 52% of Texans, said they had opted out of seeking healthcare services in the past year.

More specifically, 19% of Texans also opted out of preventive care and 11% out of emergency care.

39% of Texans who said they didn’t seek healthcare services said one reason is because they couldn’t afford it.

One in Three Texans Experienced Surprise Medical Bill in Past Year

32% of Texans have experienced a surprise medical bill in the past year.

For one out of ten of these Texans, the surprise medical bill topped $10,000.

Texans’ Surprise Medical Bills

$2,000 or less: 57%

$2,000 or more: 43%

More than $10,000: 10%

$10,001 to $20,000: 7%

Over one-third, or 36% of Texans, say they have medical debt.

For 8% of Texans, the debt burden is $5,000 or more.

Lacking Savings for Healthcare Expenses

Over one-half of Texans, 57%, say they have $3,000 or less in savings to pay for medical bills.

Asked to rank healthcare expenses, 37% of Texans list health insurance as their top expense, followed by medical bills and prescription drugs in a tie for second place at 20%.

Mixed Views on Health Insurance Options

Texans have mixed views on the range, accessibility and quality of health insurance options in the Lone Star State.

37% of Texans say the health insurance options in their state are either very or somewhat broad.

22% say the health insurance options in their state are either very or somewhat narrow, and another 41% say options are neither broad nor narrow.

46% of respondents in Texas say it’s either very or somewhat easy to access health insurance in their state.

That compares to 22% of Texans who say it’s either very or somewhat difficult to access health insurance, and 31% who say it’s neither easy nor difficult.

51% of Texans rate the quality of health insurance in their state either very or somewhat good.

20% of Texans find the quality of health insurance either very or somewhat poor, and 28% who say it’s neither good nor poor.

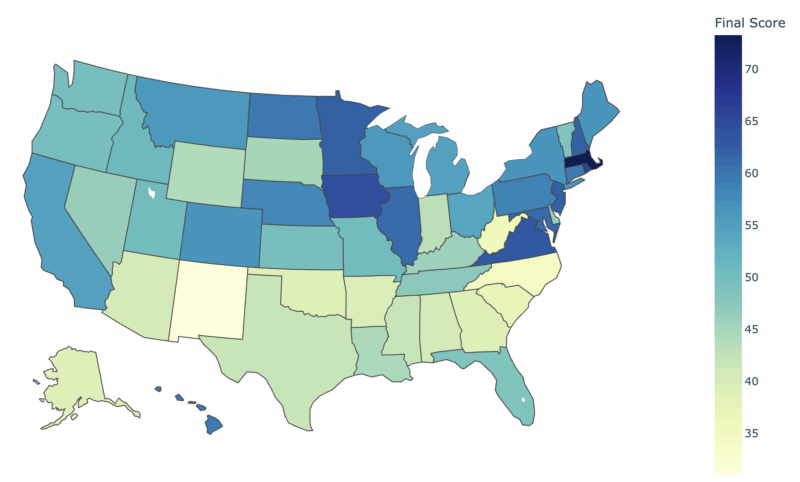

Texans’ Health Finances Trail Nation’s

Texans fared worse than the national average on a number of metrics recorded in HealthCareInsider’s nationwide poll conducted in October 2020.

The 61% of Texans who worry about medical bankruptcy and debt, for instance, is five percentage points higher than the national average of 56%.

The Texas uninsured rate is 21%, almost twice the average of 13% recorded in October 2020.

Meanwhile, the 58% of Texans who lack coverage because they can’t afford it is five percentage points higher than the national average of 53%.

Among respondents who opted out of seeking healthcare services in the past year, Texas’ rate of 52% is six percentage points higher than the national average of 46%.

Texans also trail the nation on pocketbook issues.

The 32% of Texans who experienced a surprise medical bill in the past year is four percentage points more than the national average of 28%.

At 57% of Texans, Lone Star State residents are also seven percentage points more likely to say they have $3,000 or less in savings to pay for medical bills.

Pocketbook Pain Points

Methodology

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1038 adults. Fieldwork was undertaken between February 26th – March 3rd 2021. The survey was carried out online. The figures have been weighted and are representative of all Texas adults (aged 18+).

Thank you for your feedback!