Written by Hal Levy

Healthcare Writer

We want to help you make educated healthcare decisions. While this post may have links to lead generation forms, this won’t influence our writing. We adhere to strict editorial standards to provide the most accurate and unbiased information.

The health insurance Open Enrollment Period for 2022 will be over in a flash, putting pressure on Americans to make quick decisions about their healthcare coverage.

This year, 10 states and Washington, D.C. matched or extended the 10-week health insurance open enrollment period laid out by the federal.

When Does Open Enrollment End? It Depends on Where You Live

Eleven States Extend 2022 Open Enrollment for Health Insurance

- California: November 1 – January 31

- Colorado: November 1– January 15

- Connecticut: November 1 – January 15

- Massachusetts: November 1 – January 23

- Minnesota: November 1 – December 22

- Nevada: November 1 – January 15

- New Jersey: November 1 – January 31

- New York: November 1 – January 31

- Pennsylvania: November 1 – January 15

- Rhode Island: November 1 – January 23

- Washington: November 1 – January 15

- Washington, D.C.: November 1 – January 31

Shoutout to California, New Jersey, New York and Washigton, D.C. for thumbing their nose at the 2022 health insurance open enrollment dates. Their open enrollment periods last far longer than other states.

Which the Other States Can Still Extend Their Health Insurance Open Enrollment Period?

Health insurance open enrollment extensions for Obamacare could be seen as a partisan issue, with Democrats in favor of longer enrollment periods and Republicans against them. However, open enrollment benefits are popular enough for very fine folks on all sides to have embraced them in the past.

Not every state can change the dates for the upcoming open enrollment for health insurance. These four states run their own exchange and can push back open enrollment:

States can extend open enrollment at any time, even once it’s already underway. For instance, Maryland waited until the last day it could to extend its open enrollment.

COVID Special Enrollment Period

The coronavirus upended many things in 2021, health insurance enrollment among many on that list.

The American Rescue Plan reopened the federal and state Health Insurance Marketplaces for enrollment. The Special Enrollment Period lasted from February 15, 2021 through August 15, 2021. You did not need to qualify for a specific life event in order to enroll in or change an existing plan

Residents in the following states can still buy policies until the following dates:

- California: December 31, 2021

- Connecticut: October 31, 2021

- Washington, D.C.: through the end of the public health emergency

- New Jersey: November 30, 2021

- New York: December 31, 2021

Facing a Shrinking Health Insurance Open Enrollment

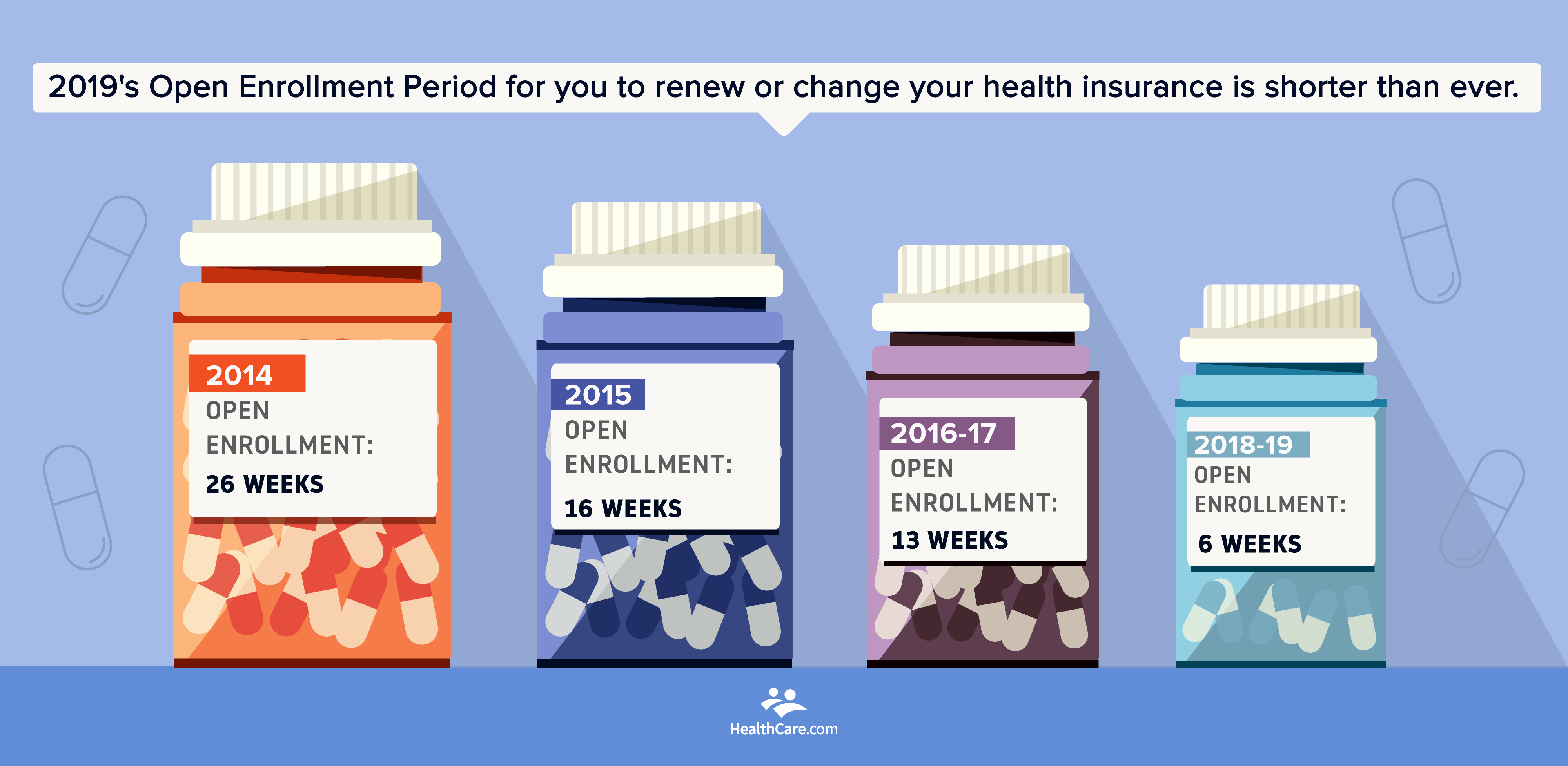

Obamacare’s first Open Enrollment Period for 2014 was 26 weeks long – that’s half of a year. For 2015, open enrollment was decreased to 16 weeks. For both 2016 and 2017, the health insurance Open Enrollment Period lasted 13 weeks.

In April 2017, the Department of Health and Human Services shocked insurance producers by reducing the 2018 Open Enrollment Period to six weeks. By announcing the change in the middle of the year, the government gave consumers minimal warning to prepare for a busier enrollment period. Local community groups that work to sign their neighbors up for healthcare were equally off-guard.

However, since the Affordable Care Act was first passed, the Open Enrollment Period was set to decrease to just 6 weeks by 2019.

But in 2021, the federal government extended open enrollment to ten weeks, ending it on January 15.

What’s the Purpose of Open Enrollment for Health Insurance Anyway?

Were you healthy when you first bought health insurance? You pay your health insurer a little bit every month, and they give back a lot when you need care. If everyone waited until they were sick to buy insurance, then there would be no money for insurers to give back.

To solve this enrollment problem, the Affordable Care Act created this national Open Enrollment Period. During this annual health insurance open enrollment, everyone is supposed to buy or re-enroll in health insurance all at once. Outside of this Open Enrollment Period, buying healthcare becomes difficult.

Why Are Longer Health Insurance Open Enrollment Periods Better?

Open enrollment is your best chance to:

- Get a different insurance company, or

- Change your health insurance network type.

A great deal of flexibility disappears with a shorter open enrollment period. In 2021, the federal government added more funding to nonprofit programs that let people know about open enrollment and help them sign up for insurance.

And This Year Isn’t Just Shorter

Several other changes were made over the past few years that will magnify the impact of a shorter health insurance Open Enrollment Period.

No More Individual Mandate: The tax penalty for going without health insurance no longer exists starting in 2019. This will remove one incentive to get health insurance in a timely manner, as stragglers can now rely on short-term insurance plans to fill coverage gaps instead. To date, only 4 states have added a local individual mandate.

Stricter Special Enrollment Requirements: Previously, the federal government would take your word for it if you tried to join a plan outside of open enrollment due to a special circumstance. As of this year, there are strict verification standards that involve sending the documents in a short period of time.

Removal of Non-Payment Loophole: Some consumers had also learned to stop paying their premiums in the months leading up to open enrollment. They bet that it would take a while for their coverage to be canceled, or even decided to lose coverage since they no longer needed it. This five-finger discount loophole was closed for 2018. Now, you’ll only be able to switch to new coverage if your old coverage is paid in full. Consumers – especially those who are behind on payments by accident – may not be able to learn about the issue, reconcile their bills, and sign up in time.

Why Would Anyone Shorten the Health Insurance Open Enrollment Period?

Insurers tend to be uncomfortable with a long health insurance open enrollment (even though they want customers). During open enrollment, people will wait to get sick before applying for coverage that a company is required to provide. Open enrollment must be short enough that insurers will be able to offer coverage without going broke, while still being a fair length for consumers who want to sign up.

At this point, the 2022 health insurance open enrollment is about as short as it can be. If you want lifespans to grow, you might want open enrollment to stop shrinking.

Thank you for your feedback!

The White House. Executive Order on Strengthening Medicaid and the Affordable Care Act. whitehouse.gov (accessed January 28, 2020).