Written by Michael LaPick

Healthcare Writer

We want to help you make educated healthcare decisions. While this post may have links to lead generation forms, this won’t influence our writing. We adhere to strict editorial standards to provide the most accurate and unbiased information.

Key Takeaways

-

Losing employer coverage qualifies you for a Special Enrollment Period.

-

Options include COBRA, ACA marketplace plans, Medicaid, and short-term health insurance.

-

Compare costs and timing to choose the right coverage for your needs.

Overview

Losing your job—or changing jobs mid-year—can feel overwhelming. On top of adjusting to a new routine, many people worry most about one thing: health insurance. If you’ve lost employer coverage, you may wonder how to protect yourself and your family without overpaying. The good news? You do have options. This article explains the most common choices for medical insurance for unemployed workers or those switching jobs, so you can stay covered with confidence.

Why Losing Employer Coverage Matters

Employer-sponsored health insurance covers more than half of working Americans. When you lose that coverage—whether from a layoff, quitting, or changing jobs—you don’t have to wait until the next open enrollment to get new insurance. Instead, you qualify for a Special Enrollment Period (SEP), giving you the chance to sign up for a new plan mid-year. Understanding your rights and options is key to avoiding gaps in care.

Your Health Insurance Options When You Lose Coverage

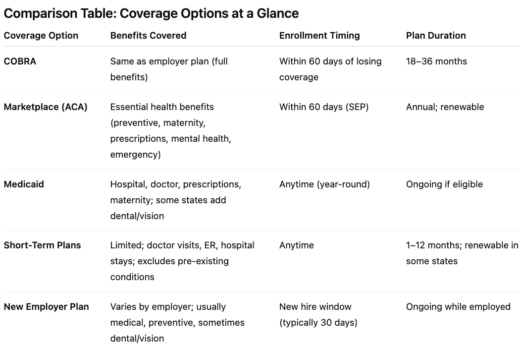

1. COBRA Coverage

COBRA insurance allows you to continue your employer’s group health plan for up to 18 months.

-

Pros: You keep the same doctors, network, and benefits.

-

Cons: You pay the full premium (your portion plus your employer’s), which can be expensive.

-

Best for: People who are in active treatment, have ongoing prescriptions, or want seamless coverage during a short job gap.

Benefits Covered: Same as your employer plan (preventive care, prescriptions, hospital care, specialists).

When You Can Enroll: Within 60 days of losing employer coverage.

Plan Duration: Typically 18 months; up to 36 months in special cases.

2. ACA Marketplace Plans (Affordable Care Act)

If you’ve lost insurance, you can shop for new coverage through the Health Insurance Marketplace.

-

Pros: Some may qualify for subsidies that reduce monthly premiums and out-of-pocket costs.

- Check Eligibility: Use our ACA subsidy calculator to estimate your subsidy eligibility based on your income and household size.

-

Cons: Networks may be narrower than employer plans.

-

Best for: Unemployed workers looking for affordable, longer-term coverage.

Benefits Covered: Essential health benefits (preventive care, maternity, prescriptions, mental health, emergency services).

When You Can Enroll: Within 60 days of losing coverage (SEP).

Plan Duration: Annual coverage; renewable during open enrollment.

3. Medicaid

Depending on your income and state, you may be eligible for Medicaid, a low-cost or no-cost program.

-

Pros: Comprehensive coverage with minimal costs.

-

Cons: Eligibility rules vary by state.

-

Best for: Individuals or families with limited income after job loss.

Benefits Covered: Hospital care, doctor visits, prescriptions, maternity care, and often dental/vision (varies by state).

When You Can Enroll: Anytime; Medicaid enrollment is year-round.

Plan Duration: Ongoing as long as eligibility is maintained.

4. Short-Term Health Insurance

Short-term health plans are temporary options that can bridge coverage gaps.

-

Pros: Lower monthly premiums.

-

Cons: Limited benefits, excludes pre-existing conditions, not ACA-compliant.

-

Best for: Healthy individuals needing coverage between jobs.

Benefits Covered: Doctor visits, urgent care, ER, hospital stays; often excludes maternity and mental health.

When You Can Enroll: Anytime (no SEP needed).

Plan Duration: Usually 1–12 months; renewable up to 36 months in some states.

5. New Employer Coverage

If you’re switching jobs, you may be able to enroll in your new employer’s plan quickly.

-

Tip: Ask HR about waiting periods and consider COBRA or an ACA marketplace plan as a bridge.

Benefits Covered: Varies by employer but typically includes medical, preventive, and sometimes dental/vision.

When You Can Enroll: During your new hire enrollment window (usually within 30 days).

Plan Duration: Ongoing while employed and enrolled.

Common FAQs

Q: Do I have to wait until open enrollment to get new insurance?

No. Losing employer coverage triggers a Special Enrollment Period.

Q: Can I switch from COBRA to a marketplace plan later?

Yes, but only during open enrollment or if COBRA ends.

Q: What if I miss the 60-day window after losing coverage?

You may have to wait until the next open enrollment unless you qualify for another SEP.

Action Steps If You’ve Lost Coverage

-

Confirm the exact date your employer coverage ends.

-

Evaluate your budget. Compare COBRA costs vs. marketplace subsidies.

-

Check eligibility. Look into Medicaid in your state.

-

Review timing. Apply within 60 days to avoid gaps.

-

Gather documents. You may need proof of lost insurance to enroll.

Bottom Line

Losing employer coverage mid-year is stressful, but it doesn’t have to leave you uninsured. From COBRA to ACA Marketplace plans, Medicaid, or short-term insurance, there are multiple paths to stay protected. Take time to weigh your budget, health needs, and future job plans before choosing. And remember—you’re not alone. Millions of Americans face this situation each year, and solutions are available to help you move forward with peace of mind.

A friendly team of licensed insurance agents is here to guide you.

Thank you for your feedback!