Written by Michael LaPick

Healthcare Writer

Reviewed by Kim Buckey

We want to help you make educated healthcare decisions. While this post may have links to lead generation forms, this won’t influence our writing. We adhere to strict editorial standards to provide the most accurate and unbiased information.

What You Need to Know

- Newborns are covered for 14 days under the mother’s plan; you must formally add them within 30 or 60 days, depending on your insurance.

- A baby is a qualifying life event, allowing you to switch plans or coverage tiers.

- Have your baby’s birth certificate ready for the process.

Expecting or adopting a baby? Congratulations! Bringing a baby into your family can be the most exciting and meaningful time in your life. Here is a comprehensive guide on health insurance for babies.

In the excitement, don’t lose sight of your baby’s health insurance.

While you’ll have a grace period, you must act quickly to add your baby to your plan, or get them their own coverage.

What Do You Need to Do Before Your Baby Is Born?

While you’re preparing for your baby to arrive, review the costs and benefits of your current health insurance and compare them to other plans and options (such as your spouse’s or partner’s plan). If you find a better option, reach out to the new insurer to make the switch after your baby is born.

If you have other children, it may not cost you more to add the newborn.

Does Health Insurance Cover Newborns?

If you have an employer-based plan

If you have insurance through an employer, your baby will be automatically covered for a set period immediately after birth. Notify your insurer or your human resources or benefits department within 30 days of the baby’s arrival to add them to the insurance plan.

Your baby will be enrolled retroactively as of their birth date and can’t be rejected for preexisting conditions. Any medical care they get in those early days will be covered if you sign up in time, even for services received before you signed up.

Some employers offer extra time to enroll a newborn. Check your company’s rules on health insurance for babies.

If you and/or your dependents are covered under Medicaid or a state Child Health Insurance Program (CHIP) but lose eligibility for that coverage, you have up to 60 days from the date you lose coverage to enroll in your employer’s plan.

If you have an individual or Exchange plan

If you’re enrolled in an individual coverage plan, or you have a federal or state Health Insurance Marketplace plan, you have 60 days to add your baby to your plan.

For hospital stays

Health insurers must cover maternity services as part of the ACA’s essential health benefits requirements.

In addition to prenatal visits and routine screenings during pregnancy, insurers must cover hospitalization for both parent and newborn for 48 hours following a vaginal delivery and 96 hours following a cesarean section delivery. If the parent or baby needs more time, the insurance company typically must approve an extension. This process is called prior authorization.

You may be entitled to additional benefits.

Depending on your plan type (for instance, an HMO or PPO), you might be entitled to additional benefits for yourself or your baby. Many large insurers have special maternity programs (though you’ll have to sign up during your pregnancy) that offer coaching, support and additional resources. Other insurers offer extra benefits like covering prenatal classes or newborn car seats.

All insurers must cover breastfeeding support and breast pumps, but the specifics of what you can get vary by plan.

Do some research before the baby is born about what your health plan offers and sign up for any special programs for pregnancy and/or newborn care.

What If You Don’t Have Health Insurance?

If you don’t have health insurance, now is the time to get it. You’ll need coverage for the baby’s delivery and for frequent newborn checkups.

Medicaid and the Children’s Health Insurance Program (CHIP)

Medicaid and the Children’s Health Insurance Program (CHIP) are insurance programs for low-income people, including pregnant women and children. Medicaid eligibility and program rules vary by state. Check with your state to see if you qualify for free or low-cost coverage. Some people on Medicaid pay a small portion of costs, while others pay nothing at all.

CHIP covers children whose families earn too much to qualify for Medicaid and, in some states, lower-income pregnant women.

Consolidated Omnibus Budget Reconciliation Act (COBRA)

If you or your spouse or partner recently lost their job at a company with at least 20 employees, you’re likely eligible for coverage through the Consolidated Omnibus Budget Reconciliation Act (COBRA).

With COBRA, you can buy your former employer’s health insurance at full price for 18 months after you’ve left the job. COBRA tends to be very expensive because the employer no longer pays any part of your premiums. But if you’re about to have a baby and you don’t have other options, COBRA may help in the short term. Check with your former employer for details about costs and the process for getting covered.

Qualified Medical Child Support Orders

Qualified Medical Child Support Orders (QMCSOs) are court or state-agency orders that require a child to be covered on a group health plan. For example, a child or stepchild may be able to access a parent’s health insurance through one of these orders.

State Programs

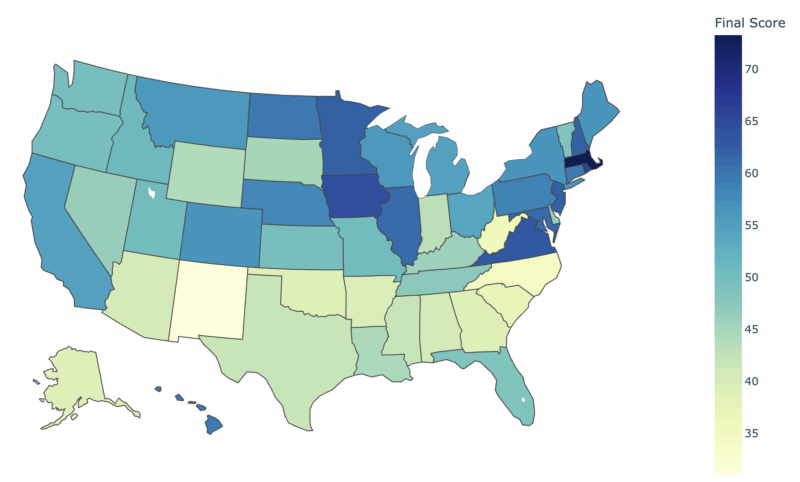

Some states, such as California, Massachusetts, Vermont and Rhode Island, as well as the District of Columbia, require every resident including newborns to have health insurance coverage. Your state may offer special coverage options. Find out the specific rules and coverage options where you live.

Can You Buy Health Insurance Just for Your Newborn?

Child-only health plans may make sense in certain situations. You may have employer-sponsored insurance with no option to include children, or you may qualify for Medicare, which doesn’t offer dependent coverage.

If you need a child-only plan and don’t qualify for Medicaid or CHIP, visit the federal or state Marketplace. Depending on your income, you may qualify for subsidies.

You may be able to buy a child-only plan directly from an insurance company, though it will likely cost more if it’s available.

In your search for health insurance for babies, beware of short-term and catastrophic plans, which may not include coverage for maternity care or for newborns.

While You Wait for Baby

While preparing for your newborn’s arrival, research your maternity and newborn benefits. Check your plan’s Summary Plan Description (SPD) and Summary of Benefits and Coverage (SBC) documents, or call your insurer. If you and your spouse/partner each have coverage through your employer, compare plans to see which makes the most sense for your family.

You may also want to check your state’s maternity and newborn coverage rules, which you can find through the National Association of Insurance Commissioners.

Reach out to your company contact or your health insurer to add your baby to your coverage, and notify them within 30 days of birth, adoption, or placement for adoption. If you have or switch to a Marketplace plan, you’ll have 60 days from the date of birth or adoption.

Then, get all the sleep you can before the baby arrives.

Thank you for your feedback!

by

Kim Buckey |

Updated on

August 17, 2025

by

Kim Buckey |

Updated on

August 17, 2025