Written by Michael LaPick

Healthcare Writer

We want to help you make educated healthcare decisions. While this post may have links to lead generation forms, this won’t influence our writing. We adhere to strict editorial standards to provide the most accurate and unbiased information.

‘Silver loading’ linked to Silver plan losses, Bronze and Gold increases

Nationwide, enrollment in health insurance plans offered in different “metal” tiers under the United States’ Patient Protection and Affordable Care Act (PPACA, or simply the ACA) peaked in 2016 at a total of 12,681,874 people. With the advent of the Trump presidency and adjustments to the law, enrollment dropped to 11,444,141 in 20191 , but the Biden administration has seen an uptick in enrollment back to 12,004,365 in 2021.

The actual number of those who select ACA exchange plans tends to run around 10% lower, as some people don’t pay their premiums or cancel their policy before it even goes into effect. But it has remained stable in recent years.

In order to standardize health insurance in the U.S., the 2010 ACA (aka Obamacare), introduced four metal levels of coverage. Ranging from cheapest to most expensive, the most popular plans are the bronze, silver and gold plans. Even cheaper catastrophic plans, and even more comprehensive premium platinum plans are also marketed, but attract far fewer customers.

In general, cheaper plans have higher deductibles and copays, while more expensive plans feature better coverage, in the form of lower deductibles and copays. Healthcare.gov estimates that bronze plans require enrollees to pay 40% of their medical costs, Silver plans 30%, gold 20% and platinum 10% of costs.2

From 2017 to 2021, the Centers for Medicare & Medicaid Services (CMS) data show that the benchmark silver plans were the most popular nationwide, followed by bronze and gold plans.3 However, silver plans suffered steady drops in enrollment, from 8,691,150 in 2017 to 6,560,684 in 2021. During this period, bronze and gold plans gained steadily in popularity. Bronze plans rose from 2,802,676 to 4,251,088 enrollees. Gold plans more than doubled from 494,969 to 990,819 in 2021.

The reasons for bronze and gold plans’ enrollment gains at the expense of silver plans are complex. But experts generally point to a 2017 action by the Trump administration’s Department of Health and Human Services (HHS) to halt reimbursing insurers for the cost of providing low-income consumers legally required reductions in out-of-pocket cost sharing (CSRs).4

Insurers responded with a strategy called “silver loading.” Despite the halt to federal reimbursements to insurers, they are still required to provide CSRs to people with incomes at or below 250% of the federal poverty level who buy silver plans on the Health Insurance Marketplace. Providers covered the costs by “Silver loading,” or raising premiums on silver plans only (while only modifying the price of bronze or gold plans based on other traditional factors) . This had the end result of lifting federal premium tax credits (PTCs) to beneficiaries, because PTCs are based on the difference between the cost of the second-lowest silver plan and a certain percentage of the enrollee’s household income.

Higher silver premiums resulted in higher tax credits, enabling many PTC beneficiaries to purchase bronze plans for effectively nothing, or gold plans for little more than the price of silver plans. In fact, in some parts of the country, some enrollees can even purchase a GOLD plan for little or nothing.

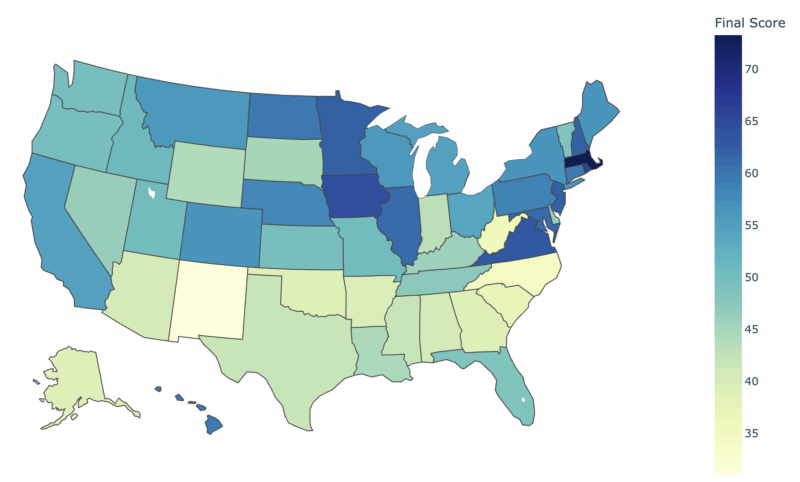

Accordingly, many states saw enrollment in silver plans drop relative to bronze and gold plans after 2017. In a number of states, including heavily populated New York and Ohio, bronze plans overtook silver plans as the most popular. In other states from Kansas to Maine, gold rose to the second most popular position, while in Wyoming, gold rose to number one among enrollees.

Each state has a unique population and mix of health insurance providers, but the dominant national trend has been bronze and gold plans gaining at the expense of silver plans. The Biden administration has made a number of proposals that could dramatically reshape America’s health insurance markets. It remains to be seen which if any of these changes will be put into effect, and how they might transform enrollment in bronze, silver and gold plans offered under the ACA.

Thank you for your feedback!

“2020 Marketplace Open Enrollment Period Public Use Files.” CMS, April 2, 2020. Unless otherwise noted, all subsequent data cited are from CMS Open Enrollment Period Public Use Files.

“Understanding Marketplace Health Insurance Categories.” HealthCare.gov. Accessed February 15, 2021.

“Marketplace Products.” CMS, March 25, 2019.

Dorn, Stan. “Silver Linings For Silver Loading: Health Affairs Blog.” Health Affairs, June 3, 2019.