Written by Michael LaPick

Healthcare Writer

We want to help you make educated healthcare decisions. While this post may have links to lead generation forms, this won’t influence our writing. We adhere to strict editorial standards to provide the most accurate and unbiased information.

Key Takeaways

- Florida Blue (BCBS) leads with the broadest network and coverage variety.

- UnitedHealthcare (UHC) offers strong ACA, employer, and Medicare plans nationwide.

- Ambetter from Sunshine Health excels in affordable ACA Marketplace options.

- Humana and WellCare dominate Medicare Advantage and prescription coverage.

- Oscar Health and Molina Healthcare stand out for digital innovation and affordability.

Overview

Finding the best health insurance in Florida can feel like trying to decode a foreign language—especially when balancing cost, coverage, and convenience. With rising premiums and shifting provider networks, choosing the right insurer is more important than ever.

To simplify your search, we analyzed leading health insurance companies in Florida based on coverage, affordability, care quality, digital innovation, and customer satisfaction. Whether you’re buying through the Marketplace, your employer, or Medicare, this guide highlights the insurers that stand out in 2026.

Comparison: Best Health Insurance Companies in Florida (2026)

| Carrier | Best For | ACA Plans | Medicare Plans | Network Size | Key Strength |

| Florida Blue | Broad access & variety | ✅ | ✅ | Very Large | Nationwide network |

| UnitedHealthcare | Broadest plan selection | ✅ | ✅ | Very Large | Multi-line coverage |

| Ambetter from Sunshine | Affordable ACA plans | ✅ | ❌ | Large | Low-cost options |

| Humana | Medicare Advantage | ❌ | ✅ | Large | Senior wellness |

| WellCare | Prescription drug plans | ✅ (limited) | ✅ | Medium | Drug coverage |

| Aetna | Employer & Medicare | ❌ | ✅ | Large | CVS integration |

| Oscar Health | Digital-first plans | ✅ | ✅ (limited) | Medium | Virtual care |

| Molina | Medicaid & ACA | ✅ | ✅ | Medium | Low-cost coverage |

Top Health Insurance Companies in Florida

Florida Blue (Blue Cross Blue Shield of Florida) – Best for Nationwide Network & Coverage Variety

Florida Blue, part of the Blue Cross Blue Shield (BCBS) network, offers ACA Marketplace, employer, Medicare, and Medicaid plans across all 67 Florida counties. Its wide provider access and global coverage options make it ideal for families and frequent travelers.

Why it’s one of the best health insurance companies in Florida:

- Comprehensive plan portfolio: ACA, Medicare, Medicaid, and employer coverage

- Strong financial stability (AM Best “A” or higher)

- Wellness and preventive care programs

- Premiums vary by region, but subsidies improve affordability

Best for: Floridians seeking reliable coverage with broad provider access.

Discover more about this carrier in our Blue Cross Blue Shield Health Insurance review.

UnitedHealthcare – Best for Broad Coverage and Plan Variety

UnitedHealthcare (UHC) is one of the largest and most trusted names in U.S. health insurance. In Florida, it offers ACA Marketplace, Medicare Advantage, employer, and short-term coverage, backed by a network of 1.3 million providers and 6,700 hospitals nationwide.

Highlights:

- ACA plans are available in 30 states, including Florida

- Covers 96% of Medicare-eligible U.S. counties

- Broad lineup: ACA, Medicare Advantage, Medigap, D-SNP, STM, and employer plans

- Virtual-first care, CareFlex Visa health card, and advanced wellness tools

- Global access through UHC Global in 130+ countries

Best for: Individuals and families seeking flexible plan options and robust care networks.

Considerations: While ACA and employer plans are competitively priced, Medigap and Part D premiums have risen in some regions. Customer complaints often cite claims handling and billing clarity.

Discover more about this carrier in our UnitedHealthcare Health Insurance review.

Ambetter from Sunshine Health – Best for Affordable ACA Marketplace Plans

A subsidiary of Centene Corporation, Ambetter from Sunshine Health covers 63 Florida counties through ACA Marketplace plans. With Bronze, Silver, and Gold tiers—and optional Value and Select plans—it’s a strong choice for budget-conscious consumers.

Highlights:

- Competitive premiums with cost-sharing reductions

- 24/7 telehealth and My Health Pays® wellness rewards

- Integrated maternity and behavioral health benefits

- Frequent billing and network complaints reported

Best for: Individuals and families under 65 seeking affordable, flexible ACA coverage.

Quick Tip:

If you qualify for Marketplace subsidies, Ambetter’s Silver plans often provide the best cost-benefit balance. Regardless of your income, make sure to estimate your eligibility using our ACA Subsidy Calculator.

Discover more about this carrier in our Ambetter from Sunshine Health insurance review.

Humana – Best for Medicare Advantage Coverage

Humana serves millions of Floridians through Medicare Advantage, Medigap, and Part D plans. With extras like dental, vision, hearing, and fitness memberships, it’s a top pick for retirees.

Highlights:

- Medicare Advantage plans with $0 premiums in many counties

- PPO, HMO, and Special Needs Plans (SNPs) available

- Recent declines in CMS Star Ratings may affect availability

Learn more about Florida Medicare Advantage plans.

Best for: Retirees seeking comprehensive Medicare coverage with strong wellness benefits.

Discover more from this carrier in our Humana Health Insurance review.

WellCare – Best for Prescription Drug and Special Needs Plans

Owned by Centene Corporation, WellCare specializes in Medicare Advantage and Part D prescription drug plans. It offers flexible coverage and $0 premium drug options across Florida.

Highlights:

- Medicare Advantage and PDP coverage statewide

- Flexible benefits with Wellcare Spendables™ card

- Telehealth and multilingual app experience

- Above-average complaint rates in certain counties

Best for: Seniors and dual-eligible beneficiaries focused on drug coverage and value.

Discover more from this carrier in our WellCare Health Insurance review.

Aetna – Best for Employer and Medicare Coverage

Aetna, part of CVS Health, offers robust Medicare and employer-sponsored coverage throughout Florida. Although the company is exiting the ACA Marketplace by 2026, its employer plans remain widely accessible.

Highlights:

- Nationwide provider network and integrated CVS pharmacy benefits

- Competitive Medigap and employer plan pricing

- Mixed consumer reviews regarding billing and claims communication

Best for: Employees and retirees seeking seamless integration between health and pharmacy services.

Discover more from this carrier in our Aetna Health Insurance review.

Oscar Health – Best for Digital Care Experience

Known for its tech-forward approach, Oscar Health provides ACA and small group plans in select Florida counties. Its mobile app offers $0 virtual urgent care, $3 prescriptions, and chronic condition support.

Highlights:

- Strong digital tools and a virtual-first care model

- Competitive pricing for ACA enrollees

- EPO networks with limited provider flexibility

- Higher complaint rates in some areas

Best for: Digital-savvy consumers who prefer managing their care online.

Discover more from this carrier in our Oscar Health Insurance review.

Molina Healthcare – Best for Low-Income and Medicaid Members

Molina Healthcare focuses on affordability through ACA, Medicaid, and Medicare Advantage plans. Its community-based model emphasizes care coordination and preventive support.

Highlights:

- Low-cost or $0 premium ACA and Medicaid options

- Dual-eligible plans combining Medicare and Medicaid benefits

- Narrow networks but improving transparency

- Mixed NCQA and CMS quality ratings

Best for: Lower-income individuals and families seeking dependable, affordable coverage.

Discover more from this carrier in our Molina Health Insurance review.

Methodology

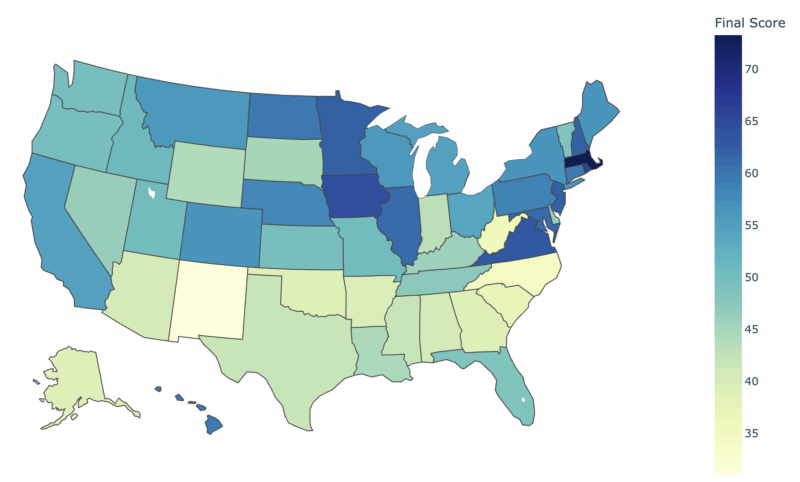

This guide evaluates companies offering the best Florida health insurance plans, drawing from our comprehensive insurer review series. Each provider was analyzed for coverage area, plan variety, affordability, digital tools, care quality, and transparency.

Financial stability was verified through AM Best, while customer satisfaction was drawn from NCQA, the American Customer Satisfaction Index (ACSI), and J.D. Power. Complaint ratios were cross-checked using the National Association of Insurance Commissioners (NAIC) index, and plan participation data was confirmed through CMS.gov and Healthcare.gov.

These combined metrics create a balanced picture of affordability, reliability, and member experience for Florida consumers.

Frequently Asked Questions (FAQ)

Do ACA plans cover maternity and mental health?

Yes. Under the Affordable Care Act, all Marketplace plans must cover 10 essential health benefits, including maternity, mental health, and prescription drugs.

Is Florida Blue the same as Blue Cross Blue Shield?

Yes, Florida Blue is the local Blue Cross Blue Shield licensee serving all 67 counties in Florida.

Can I buy short-term medical or off-exchange coverage in Florida?

Yes. UnitedHealthcare offers short-term medical plans in Florida in select counties. These are not ACA-compliant and may exclude pre-existing conditions.

Bottom Line

Choosing the best health insurance in Florida depends on your health needs and budget.

- For ACA coverage, consider Ambetter from Sunshine Health, Florida Blue, or UnitedHealthcare.

- For Medicare, Humana, WellCare, and Aetna lead the field.

- If you value innovation, Oscar Health and UnitedHealthcare offer best-in-class digital tools.

- For affordability, Molina Healthcare remains a dependable low-cost option.

Compare plans on our website via Healthcare.com, our parent company, or with a licensed insurance agent to see how each insurer performs in your ZIP code.

A team of licensed insurance agents are here to help you compare plans

The views and opinions expressed are those of the authors and do not necessarily reflect the official policy or position of HealthCareInsider.com or HealthCare, Inc.

Thank you for your feedback!