Written by Jennie Phipps

HealthCare Writer

Reviewed by Frank Lalli

We want to help you make educated healthcare decisions. While this post may have links to lead generation forms, this won’t influence our writing. We adhere to strict editorial standards to provide the most accurate and unbiased information.

What You Need to Know

- Health insurance you buy without your employer’s help doesn’t have to be expensive. Check out this list of highly recommended healthcare insurance companies.

- Health insurance pricing and availability is regional—right down to the county level. That’s why your state insurance department is a great place to turn for assistance if you need additional help finding health insurance with no job or income.

How to Get Health Insurance Without a Job

Can you get health insurance if you don’t have a job that offers it? Absolutely. Even with no income, you still have access to affordable—and in some cases free—health insurance options. Understanding your choices is the first step to protecting your health and financial well-being.

This guide explains how to get health insurance without a job, what options are available in every state, and how to decide which type of coverage fits your needs best.

Below are the seven best ways to get health insurance if you’re unemployed or have no income.

How to Get Health Insurance Without a Job: Your 7 Best Options

If you’re unemployed or earn little to no income, you still have several ways to get reliable health insurance. Your main options include:

-

COBRA coverage after a job loss

-

Affordable Care Act (ACA) Marketplace plans

-

Medicaid or CHIP if your income qualifies

-

Private individual health plans

-

Short-term health insurance

-

High-deductible health plans with HSAs

-

Medicare (if age-eligible)

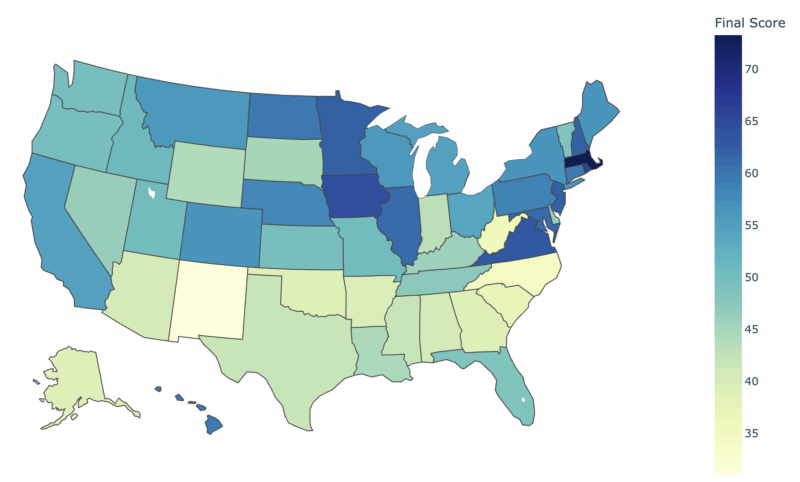

Here’s a state-by-state guide to health insurance that will get you started.

COBRA Medical Insurance

Perhaps you have recently lost your healthcare because you lost your job. Or the person on whom you depended for health insurance lost his or hers. In either case, one way to replace your insurance is through COBRA medical insurance (the Consolidated Omnibus Budget Reconciliation Act), which gives people the right to remain enrolled in their old employer’s group health plan by paying for it out of pocket; in nearly all cases, the employer no longer contributes.2

COBRA lets you keep the exact same health plan you had through your employer, which is helpful if you or a family member needs ongoing or specialized care. It’s also a practical short-term option if you’re starting a new job but are still in a waiting period for benefits. However, COBRA can be expensive—your costs may rise by up to 80% because your former employer no longer contributes.

- Your employer must notify the insurer of your COBRA eligibility, and you have 60 days to enroll and pay your first premium. In some cases, financial assistance may be available for you, your spouse, or your dependents.

- If you recently lost coverage due to job loss, COBRA is the fastest way to avoid an insurance gap. But if your income has dropped, you may qualify for lower-cost ACA plans with substantial subsidies.

- One word of warning: If you expect to qualify for Medicare within a few months, don’t rely on COBRA past your Medicare eligibility date because you could find yourself paying an ongoing Medicare penalty.3

Affordable Care Act (ACA )or Obamacare Plans

The Health Insurance Marketplace offers Affordable Care Act (ACA) or Obamacare health plans that meet the generous requirements of the ACA. People can’t be refused insurance or charged more because they have a preexisting condition—a boon for many.4 Depending on your income, you’ll probably qualify for a premium discount (or “subsidy”) and perhaps lower co-insurance costs, as well. You can calculate your eligibility using our ACA subsidy calculator.

To buy a plan, contact a health insurance broker or go directly to the Marketplace website. There is an Open Enrollment Period each fall for getting coverage or updating a plan. The window to enroll is between November 1 – January 15 in most states.

If you miss that window, you may qualify for an immediate 60-day Special Enrollment Period if you lose your prior coverage, give birth adopt a baby, or get married.

Individual Private Health Insurance Plans

Insurance companies are allowed to sell insurance policies that don’t meet the requirements of the ACA to you. Some of these policies are considerably cheaper for people who don’t qualify for ACA discounts, but they typically don’t offer many of the 10 essential health benefit protections covered in all ACA plans.

- You can buy private insurance through brokers and directly from health insurance companies.

- They are sold year-round and can be good for people who only want low-premium preventive and emergency coverage or for those who don’t meet the requirements to purchase insurance during ACA enrollment periods.

High-Deductible Health Plans

High-deductible health plans (HDHPs) are what they sound like—the policyholder pays a significant amount (the deductible) out of pocket before coverage kicks in. To get tax benefits, the IRS requires that you must meet the deductible of $1,600 for individual coverage and $3,200 for family coverage. But some deductibles climb to five figures.

- These plans are sold through the ACA and as private health insurance. If you buy one in conjunction with a health savings account (HSA), and stay healthy, you can save a considerable amount tax-free as long as you ultimately spend the money on healthcare.

- Anything you don’t spend remains in your HSA account from year to year, and it can be invested tax-free.

- These plans can be advantageous for people who do not develop chronic conditions because the HSA’s ultimate balance can fatten a retirement plan.

Short-Term Health Insurance

These largely preventive and emergency policies, offered in many but not all states, can get you over the hump from one employer insurance to another, from employer insurance to Medicare, or in other circumstances where you need coverage for three months.

- Many of these short-term health policies have significant coverage limitations and dollar caps on total coverage. Claims may result in cancellation, too.5

- Check out these recommended policies. By definition, this type of insurance isn’t a long-term solution, but it might be a short-term bridge to comprehensive coverage, perhaps at your next job.

Medicaid and Children’s Health Insurance (CHIP)

State and federal governments both kick in to pay for these programs, which provide free or low-cost healthcare for low earners, some disabled people and children up to age 19.

- In recent years, 40 states and the District of Columbia have expanded their Medicaid programs to provide care for all people who earn below a state-defined poverty level, often 138% of modified adjusted gross income (MAGI), as defined by the federal government. Others consider assets and define eligibility more narrowly. Use this questionnaire to see if you are likely to qualify.

Medicare

This program provides health insurance for people 65 and over. Some people with disabilities, including permanent kidney failure, can qualify at younger ages.7

- Original Medicare pays around 80% of beneficiaries’ medical bills, so most people also buy Medicare Supplement Insurance, also known as Medigap, to pick most of the remaining 20%.

- Others buy all-in-one Medicare Advantage plans, which are regulated by the federal government but sold and managed by private insurance companies, including Humana, United HealthCare and Anthem.

These programs and the rules that govern them are complicated, so carefully consider your options when first purchasing a plan. You can face problems, for example, if you don’t act during your initial enrollment period as you turn 65.

- For one, it can be difficult to switch from Medicare Advantage to Original Medicare after your initial Medicare enrollment period without incurring extra costs. Also, Medigap companies in your state may be allowed to reject you if you have preexisting conditions.8

Frequently Asked Questions About Getting Health Insurance Without a Job

1. Can I get health insurance with no income?

Yes. Medicaid is available to low-income adults in most states. If your state hasn’t expanded Medicaid, you may still qualify based on assets or other factors.

2. What’s the cheapest health insurance if I’m unemployed?

Typically:

-

Medicaid (free or low-cost)

-

Subsidized ACA plans, which can reduce premiums dramatically

3. Can I get Marketplace insurance without a job?

Yes. Your employment status does not affect your ability to get an ACA plan. Subsidies are based on your expected income, not your job.

4. How long after losing my job can I get coverage?

You have 60 days to enroll in:

-

COBRA

-

A Marketplace plan via Special Enrollment

5. Does unemployment compensation count as income for ACA subsidies?

Yes. Unemployment benefits often count toward your modified adjusted gross income (MAGI).

Next Steps

Finding health insurance without a job may seem overwhelming, but many affordable options are available. Whether you choose an ACA plan with subsidies, Medicaid, COBRA, or a private policy, you can access coverage that protects your health and finances.

If you need help choosing the right plan, contact a licensed agent or your state’s insurance department for personalized guidance.

Thank you for your feedback!

Consumer Financial Protection Bureau, July 2019. Market Snapshot – Third-Party Debt Collections Tradeline Reporting. files.consumerfinance.gov (accessed Nov. 24, 2025).

U.S. Department of Labor. Continuation of Healthcare Coverage. dol.gov (accessed Nov. 24, 2025).

National Association of Health Underwriters. Cobra as Creditable Coverage. nahu.org (accessed Nov. 24, 2025).

U.S. Department of Health & Human Services. Pre-Existing Conditions. hhs.gov (accessed Nov. 24, 2025).

Pollitz K, et al. Kaiser Family Foundation. Understanding Short-Term Limited Duration Health Insurance. kff.org (accessed Nov. 24, 2025).

Garfield R, Orgera K, & Damico A. Kaiser Family Foundation. The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand Medicaid. kff.org (accessed Nov. 24, 2025).

Social Security Administration. Medicare Benefits | SSA. ssa.gov (accessed Nov. 24, 2025).

Medicare & Medicaid Services. Consider These 7 Things When Choosing Coverage. Medicare.gov (accessed Nov. 24, 2025).

by

Frank Lalli |

Updated on

November 25, 2025

by

Frank Lalli |

Updated on

November 25, 2025