Whether you’re seeking individual coverage for yourself, or you’re a business owner trying to find the best healthcare option for your employees, using an agent or broker can save you time and money. Brokers simplify the process of buying health insurance and they make it easier to find coverage well-suited to your needs. If and when you decide to work with a broker to get individual health insurance, here’s some things to keep in mind and what you should expect.

What Does a Health Insurance Broker Do Exactly?

A health insurance broker is a licensed benefits professional who can help individuals and businesses manage the health insurance selection process from start to finish. While some people prefer to research plan options on their own, others are overwhelmed by the process of buying health insurance and can benefit from professional assistance. Insurance agents and brokers also help business owners sift through available options to find a healthcare plan that’s compatible with the needs and budget of their company.

You can use HealthCareInsider.com’s web form to choose a plan on your own, or call HealthCareInsider.com’s phone number to connect with a licensed insurance broker.

Agents vs. Brokers: What’s the Difference?

The terms agent and broker are often used interchangeably, though there are some key differences.

Health Insurance Agent: Insurance agents have contractual agreements with insurers directly. Generally, health insurance agents work on behalf of one insurance company, selling only that company’s plans. For example,an agent working with Aetna will offer only Aetna plans.

Health Insurance Broker: Insurance brokers act independently – separate from insurers, working with several carriers who pay them either a percentage or flat-fee commission on plans they sell to clients. If you’re working with a health insurance broker, the plans he or she will offer you are ones for which they have a stake in selling.

The Benefits of Using a Health Insurance Broker to Find Individual Health Insurance

When you purchase health insurance through a licensed broker, you have the peace of mind in knowing that your individual or employer-sponsored plan offers the right coverage at the most affordable price.

Working with a broker to get individual health insurance can be extremely valuable for some people. Here are some of the ways in which their services are helpful:

- Quick Access to Support: Planholders have a designated person to contact if they need help solving problems with claims payments, coverage eligibility, access to care and other issues—which you can’t get on a website.

- Personalized Recommendations: Brokers can explain the pros and cons of different benefits packages. They offer personalized advice to help people select the right plan.

- Provide Specialized Health Insurance Knowledge: Brokers can help you understand key healthcare coverage terms and help you make sense of your available options. Brokers can also help elderly consumers better understand their Medicare coverage and options for long-term care.

What Happens When You Talk to a Health Insurance Broker

When you use HealthCare.com, we’ll give you the option to connect with an independent and locally-licensed agent or broker.

1. The Broker Will Try to Understand Your Situation

A health insurance broker may ask you:

- Are you buying health insurance for the first time?

- Do you currently have health insurance coverage? Why do you want to switch plans?

- How often do you go to your doctor? Do you see any specialists? Would you like to keep your current doctor(s)?

- Do you currently take prescription drugs? Do you require the branded version of any medications?

- What is your budget?

- Are you planning to add a spouse or dependents to your plan?

- Which pharmacies do you use?

2. You’re Presented with Plans to Fit Your Needs

After speaking with you to go over your needs, your health insurance broker’s next duty is to put together a portfolio of health insurance options for you. Here are the things you’ll need to consider at this step:

- Differentiate Between Insurance Plan Types: Have the broker walk you through different insurance plan types: HMO, PPO, EPO, and POS. Your broker will explain the pros and cons of each plan format and can tell you if certain plans require referrals, if any policies offer out-of-network coverage, etc.

- Understand Pricing Terms: Understand key pricing terms (deductible, premium, coinsurance, copay, and so on) to learn how your coverage options differ. Work with your broker to narrow down and select the option best-suited to your healthcare needs.

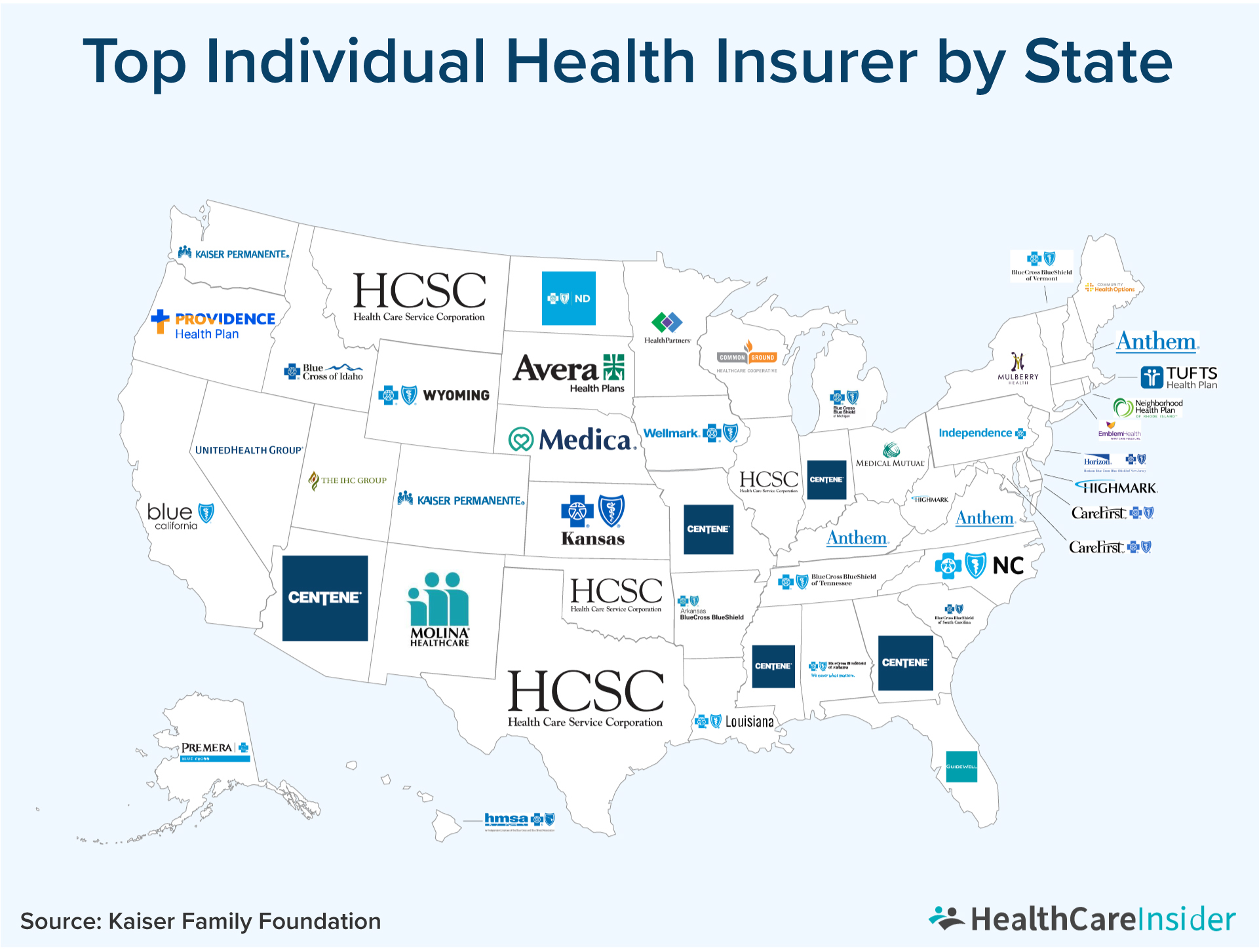

- Find the Right Health Insurance Carrier: Work with your broker to identify carriers offering plans that meet your needs.

- Compare Provider Networks: If you would like to continue receiving care from a particular doctor, examine the provider networks of each plan option. Check to make sure your doctor will be considered in-network under these plans.

- Know On- and Off-Exchange Plans: Considering the push to stop incentivizing marketplace plans, make sure your broker clarifies which of your options are ACA marketplace plans and which are off-exchange, non-ACA plans. Ask about plan options which haven’t been shown to you.

3. Select a Plan

During and after selecting a plan, there are a few important things to keep in mind.

- If you’re selecting an ACA marketplace plan, will your broker help you determine whether you’re eligible for a subsidy and if so, can he or she help you process a subsidy application?

- Can your broker walk you through your policy’s Summary of Benefits? Make sure your key points are clarified: provider network size, premium and coinsurance cost amounts, and whether or not you need to meet a plan deductible before your insurance begins to cover a portion of your healthcare costs, etc.

- Ask your broker if your insurance carrier has a designated point person whom you may contact if and when you have questions about your coverage. Can this representative provide assistance in filing claims?

- Be sure to confirm all your drugs are covered.

- If your plan includes access to a Flexible or Health Savings Account, ask your broker about the steps you need to take to establish an account and access and manage your account funds.

What to Look for in a Good Health Insurance Broker

You’ll be relying on your broker to find the best plan for your team, so it’s important to find an insurance expert who truly understands your business and employees’ needs. But once you’ve hired a broker to help you [and your employees] navigate plan selection, what should you expect from their services? Let’s take a closer look.

What to Expect When Working with a Health Insurance Broker:

- A broker’s services should be free (they get paid in commissions).

- An exceptional broker should have an in-depth understanding of employee benefits plans, as well as the communication skills to articulate these options to you in a way that is easy to understand. Your broker should be doing more than relaying insurance quotes – he or she should be focused on aligning your benefit plan options with your medical and financial needs.

- Good brokers are communicative. It should be easy to get in touch with him or her, and they should return your calls promptly if or when they are unavailable.

- Your broker should provide you with the contact information of an assigned benefits representative. This point person should be accessible and easy to reach; you should be able to call your representative about insurance claims, coverage levels, or any other questions that may arise.

- In the weeks preceding and during open enrollment, your broker should prepare a side-by-side comparison table that makes it easy for you to compare and evaluate different plan options.

- You should expect to receive information and educational materials detailing your benefits, coverage, and provider network.

- Your health insurance broker must ensure your plans are compliant with federal and state laws.

There isn’t anything secret about your health insurance plan. All the information is available, but it may not be easily accessible or understandable. A health care insurance broker already knows these things — from how to choose the right physician and how to file claims to how to pick the right plan for your family — he or she will be able to guide you through the entire process.